Merchant Bankers in Hydrabad

Merchant bankers, lead managers and registrars play a key role and facilitate primary market activities by their advice and guidance.

Corperate

capitals ventures of India provides Merchant banking services in Delhi . CCV

offers a complete range of services for Business Valuation. CCV offers a

complete range of services for Business Valuation

Merchant bankers provide advice to entrepreneurs right from

the stage of conception of the project till the commencement of production.

Merchant bankers are in charge of the issue process. They act as intermediaries

between the company and the investors. They are also responsible for preparing

the prospectus and marketing the issue.

“any person who is engaged in the business of issue management either by making arrangement regarding buying, selling or subscribing to securities or acting as manager, consultant or rendering corporate advisory services in relation to such issue management”.

Services provided by merchant bankers

in Hyderabad are:

·

Project counseling

·

Market survey and forecasting

·

Estimating the amount of funds required.

·

Raising funds from the capital market.

·

Raising of funds through new instruments.

·

Bought out deals.

·

OTC market operations.

·

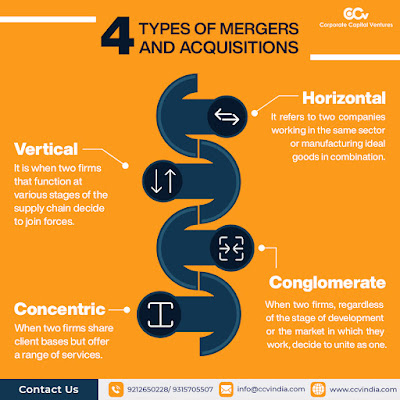

Mergers and amalgamations.

·

Loan syndication.

·

Technology tie-ups.

·

Working Capital Finance.

·

Venture Capital.

·

Lease Finance.

·

Fixed deposit management.

·

Factoring

·

Portfolio management of mutual funds.

·

Rehabilitation of sick units.

Categories of Merchant Bankers in Hyderabad

The following are the categories of merchant bankers:

Comments

Post a Comment